In currently’s unstable world-wide overall economy—Specifically across the diverse marketplaces of the Middle East and Africa—risk visibility is every little thing. No matter if you are extending credit, onboarding new shoppers, taking care of suppliers, or exploring partnerships, a company Credit history Report supplies the essential insights you might want to make knowledgeable, details-driven selections and protect your organization from avoidable exposure.

What's a company Credit Report?

A Business Credit Report is an extensive profile that summarizes a business’s fiscal wellbeing, credit conduct, authorized standing, and operational record. It is actually an essential Software for credit hazard administration, notably in rising and sophisticated marketplaces like MEA, where by transparency and regularity in business enterprise knowledge is often hard.

Critical Advantages of Employing Organization Credit score Reports in MEA

one. Make Safer Credit score Decisions

Avoid highly-priced faults by evaluating the creditworthiness of potential and current organization associates. A Business Credit history Report lets you:

Analyze economical ratios, credit score scores, and payment record

Set acceptable credit terms and boundaries

Reduce the chance of lousy personal debt and late payments

This is especially essential in locations exactly where funds move instability may be widespread due to macroeconomic fluctuations.

2. Acquire Visibility into Regional and Cross-Border Threats

The MEA location offers a novel mixture of rapid-growing economies, regulatory disparities, and political dangers. A Business Credit history Report helps you:

Standardize credit history assessments throughout international locations

Establish area-distinct pitfalls and economic circumstances

Make educated decisions even in jurisdictions with confined community disclosures

3. Streamline Onboarding and KYC Compliance

Increase your research method with instantaneous access to confirmed enterprise data. Business enterprise Credit rating Reports ordinarily include things like:

Enterprise registration and ownership aspects

Essential financial metrics and buying and selling history

Authorized filings, individual bankruptcy records, and sanctions checks

This assures compliance with interior guidelines and restrictions like AML, KYC, and international sanctions lists.

4. Keep an eye on Business Partners Proactively

The organization environment is constantly shifting, particularly in superior-growth marketplaces. Company Credit score Studies make it easier to keep up-to-date by:

Giving frequent checking and alerts

Tracking alterations in credit score scores or legal position

Flagging potential issues before they become problems

This proactive checking lowers threat and improves supplier and consumer partnership administration.

5. Make improvements to Negotiations and Strategic Scheduling

Know-how is electricity. When you have a clear perspective of a firm’s monetary health, you may:

Negotiate far better conditions according to genuine danger

System for contingencies with at-danger suppliers or buyers

Identify large-accomplishing, reduced-chance associates for long-term development

This makes certain your system is aligned with financial reality—not assumptions.

6. Improve Portfolio and Threat Management

Should you be taking care of many shoppers or sellers, Business enterprise Credit history Stories assist you to:

Section entities by sector, credit score score, or geography

Observe In general exposure and portfolio wellness

Determine risk focus and just take well timed corrective action

This leads to smarter cash allocation, improved ROI, and lessened produce-offs.

Why It Matters in the center East & Africa

Within the MEA location, in which usage of reputable company details could Business Credit Report be inconsistent, Business Credit score Experiences provide a standardized, trusted source of insight. No matter if you’re a multinational enterprise or a local SME, these experiences empower you to:

Realize the entities you need to do business enterprise with

Navigate regulatory and operational complexities

Make more quickly, smarter, and safer small business conclusions

Summary

Educated selections are thriving conclusions. With a company Credit history Report, you attain the clarity, self-confidence, and Handle necessary to deal with credit history risk successfully across the Center East and Africa. From onboarding and compliance to possibility monitoring and strategic development, this potent Instrument places the information you will need proper at your fingertips.

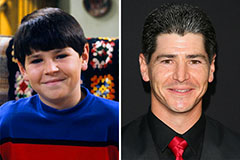

Michael Fishman Then & Now!

Michael Fishman Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now!