In these days’s rapidly-paced and unpredictable small business environment—Specially across the varied markets of the Middle East and Africa—gaining access to exact, dependable, and well timed details about the businesses you need to do business enterprise with is not optional. Organization Credit score Studies are becoming A vital tool for organizations planning to handle credit rating hazard effectively, avoid expensive defaults, and make informed selections.

one. Make Self-confident Credit score Conclusions with Responsible Information

A comprehensive corporation credit score report provides an in-depth overview of a company’s money balance, operational history, payment actions, and authorized standing. With this information at your fingertips, your team can:

Evaluate creditworthiness prior to extending terms or presenting financing

Detect purple flags like late payments, authorized disputes, or deteriorating financials

Mitigate danger by customizing credit history boundaries and conditions for every customer or provider

This is especially worthwhile in the MEA location, where by publicly readily available economical facts is commonly minimal or inconsistent.

2. Boost Possibility Administration Across Borders

Doing enterprise throughout various nations around the world in the center East and Africa signifies addressing diverse regulatory programs, levels of transparency, and financial disorders. Enterprise credit rating stories provide you with a standardized threat profile, helping you to definitely:

Assess firms throughout marketplaces making use of regular credit history scoring

Understand local context, for instance adjustments in company legal guidelines or region danger

Produce a regional credit coverage dependant on actual data as an alternative to assumptions

three. Protect Your organization from Payment Defaults

One of several major motives corporations put up with funds move difficulties is due to delayed or unpaid invoices. Enterprise credit studies enable reduce this threat by presenting:

Payment record insights, exhibiting how immediately a company pays its suppliers

Credit history score traits, indicating improving upon or worsening habits after a while

Alerts and updates, and that means you’re informed of any important alterations that could have an affect on payment dependability

Remaining proactive, as opposed to reactive, helps you keep away from pointless losses and retain a healthy balance sheet.

four. Streamline Onboarding and Homework

When bringing on new customers, companions, or sellers, a firm credit rating report simplifies and accelerates your research approach. With Company Credit Report just one doc, you are able to overview:

Organization registration and ownership structure

Key financial ratios and yearly turnover

Bankruptcy documents, lawful judgments, and regulatory flags

This hastens decision-earning when making sure compliance with internal hazard procedures and exterior rules including anti-money laundering (AML) standards.

5. Improve Negotiating Electric power and Strategic Organizing

A clear comprehension of your counterpart’s monetary health and fitness will give you leverage in negotiations. You'll be able to:

Regulate payment conditions, including necessitating advance payment or shorter credit score cycles

Approach for contingencies, by pinpointing suppliers or clients who may perhaps existing risk

Prioritize partnerships with firms that happen to be economically steady and very low hazard

Within the MEA region, exactly where financial shifts can occur quickly, this foresight is essential to defending your small business interests.

6. Assistance Portfolio Monitoring and Reporting

In the event you’re managing a large portfolio of customers, distributors, or borrowers, holding monitor of each and every entity’s credit health and fitness might be a key obstacle. Business credit rating reviews assist you to:

Check improvements eventually with periodic updates

Section your portfolio by threat level, field, or geography

Deliver actionable insights for interior reporting or board-degree conversations

This enables for far better strategic preparing, compliance reporting, and General credit history chance governance.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Nancy Kerrigan Then & Now!

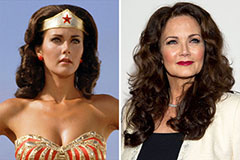

Nancy Kerrigan Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now!